rhode island tax table 2021

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR.

Rhode Island Income Tax Calculator Smartasset

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

. Those under 65 who are not disabled do not qualify for the credit. Find your gross income. Find your pretax deductions including 401K flexible account contributions.

The minimum tax is 400 per year for tax years beginning on or after January 1 2017. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Rhode Island State Income Tax Rates and Thresholds in 2022. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

The federal estate tax exemption is 1170 million in 2021 increasing to 1206 million in 2022. Find your income exemptions. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income.

Sales of tangible personal property are in Rhode Island if the property is delivered or shipped to a purchaser within this state regardless of the free on board FOB point or other conditions of the sale. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. The state income tax table can be found inside the Rhode Island 1040 instructions booklet.

Complete your 2021 Federal Income Tax Return first. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The Rhode Island estate tax is not portable between spouses.

Increased Standard Deduction Amounts Amount ax Brackets RI-4868 RI-1040V Instructions IND-HEALTH Instructions Tax Rate Schedule RI Tax Tables NEW FOR 2021. For example a single. 1 Enter your 2021RI income tax from RI-1040 line 10a less lines 14d and 14e or RI-1040NR line 13a less line 17d.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. One Capitol Hill Providence RI 02908. Tax Tables Update March 5 2021 March 5 2021 RI Rhode Island.

Rhode island tax tables 2021 A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. There is also a federal estate tax that may apply. Rhode Island Division of Taxation.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. This means that different portions of your taxable income may be taxed at different rates. This form is for income earned in tax year 2021 with tax returns due in April 2022.

The state income tax table can be found inside the Rhode Island 1040 instructions booklet. It is the basis for preparing your Rhode Island income tax return. Subscribe for tax news.

The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual. S corporation An entity treated as an S corporation for federal tax purposes must file Form RI-1120S and pay the annual minimum tax as set forth in Rhode Island General Laws 44-11-2 which is 400 for tax years beginning. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. 2021 federal capital gains tax rates. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government.

Detailed Rhode Island state income tax rates and brackets are available on this page. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The tables below show marginal tax rates.

19 20 Credit for child and dependent care expenses. For tax year 2021 the property tax relief credit amount increases to 415 from 400. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

YES Revised 122021 State of Rhode Island Division of Taxation 2021 Form RI-1040 21100199990103 Resident Individual Income Tax Return - page 3 Your social security number Names shown on Form RI-1040 or RI-1040NR RI SCHEDULE I - ALLOWABLE FEDERAL CREDIT 19 RI income tax from page 1 line 8. 2 Enter 80 of the amount shown on line 1. The Rhode Island Department of Revenue is responsible for.

The Rhode Island Division of Taxation announced today that it will be following the IRS 2022 tax filing start date of January 24 and due date of April 18 for filing Rhode Island personal income tax returns for the 2021 tax year. 4 Subtract line 3 from line 1. In gen-eral the Rhode Island income tax is based on your federal adjusted gross income.

The Rhode Island Department of Revenue is responsible for. Rhode Island will follow federal season start on 1242022 and deadline of 4182022 PROVIDENCE RI. Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below.

Directions Google Maps. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. 2022 Rhode Island Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the.

3RI withheld taxes paid for2021from RI-1040 line 14a or RI-1040NR lines 17a and 17c. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. DO NOT use to figure your Rhode Island tax.

This means that when both members of a married couple die only a single exemption of 1648611 applies not double that figure. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. General Laws 44-11-2.

Rhode Island Sales Tax Small Business Guide Truic

Delaware State Univeristy Calander University Calendar Academic Calendar Delaware State

Rhode Island Income Tax Brackets 2020

Rhode Island S 10 Safest Cities Of 2022 Safewise

Strategic Plan Rhode Island College

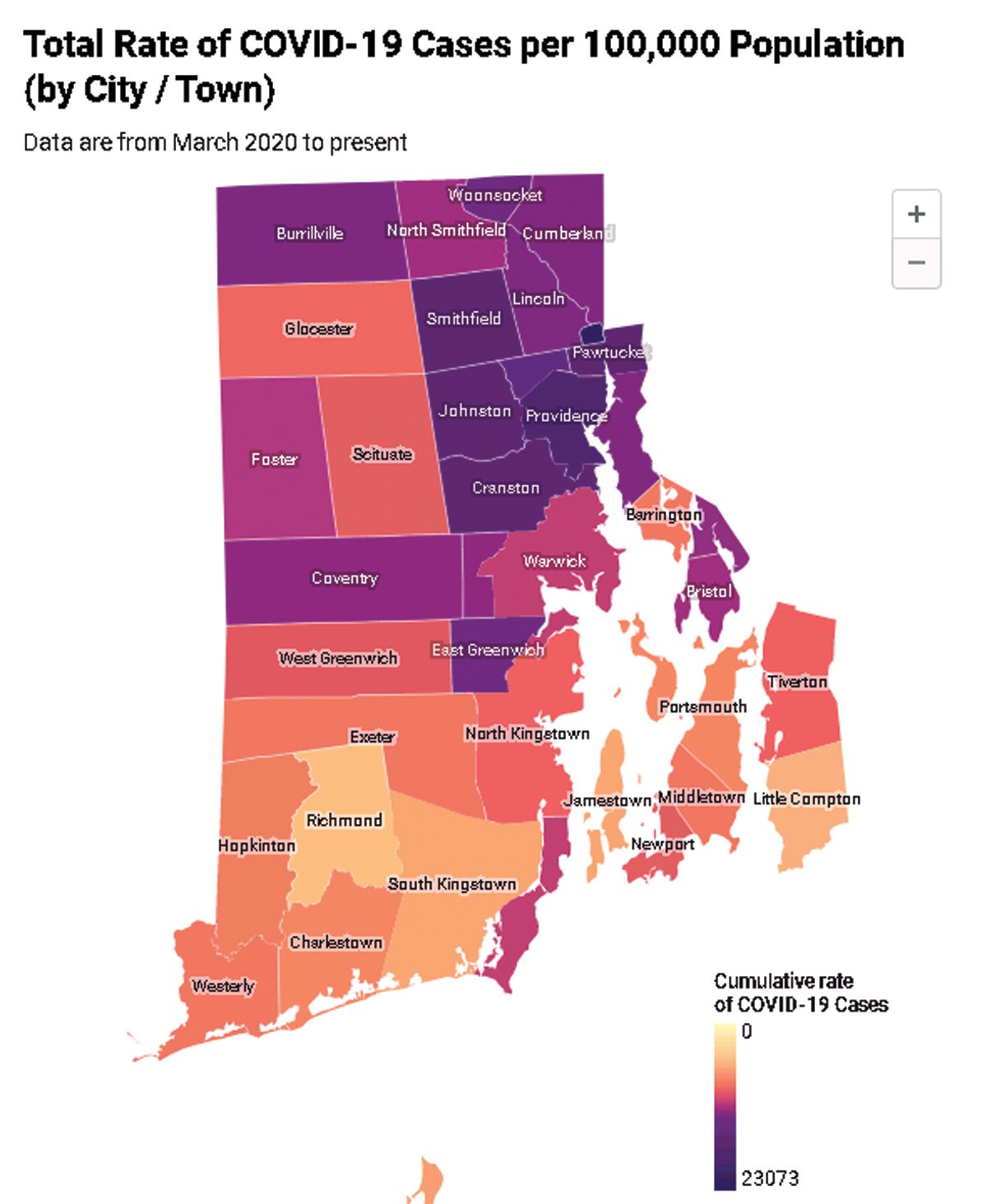

Johnston Among Rhode Island Communities Hardest Hit By Covid 19 Johnston Sun Rise

Best Criminal Justice Schools In Rhode Island

Covid 19 Information Ri Division Of Taxation

Rhode Island Agriculture Farm Flavor

Rhode Island S 10 Safest Cities Of 2022 Safewise

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island S 10 Safest Cities Of 2022 Safewise

Rhode Island S 10 Safest Cities Of 2022 Safewise

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Solved I M Being Asked For Prior Year Rhode Island Tax

Rhode Island Income Tax Calculator Smartasset

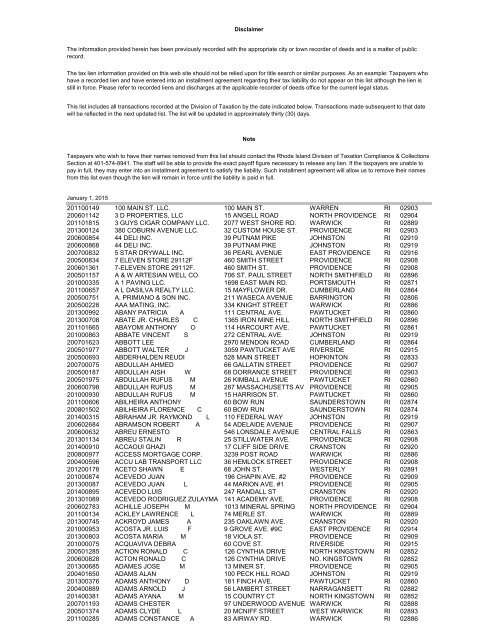

Download The Tax Lien List Pdf Document Rhode Island Division